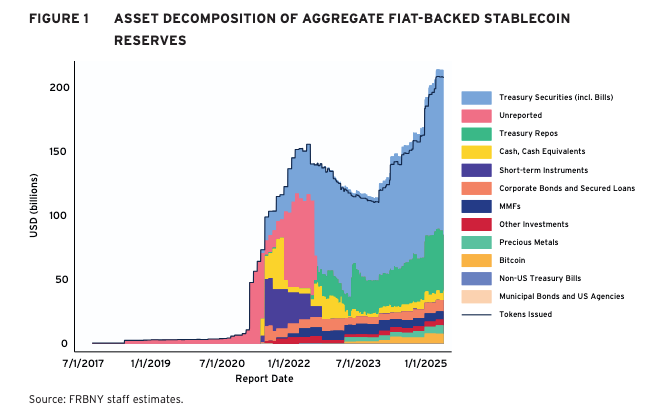

Chart of the day: What are stablecoins really made of?

Flagging one of the most interesting charts from CEPR's latest Frontiers of Digital Finance report.

We’ve been highlighting all sorts of interesting charts in our weekly aggregation post, but the one below merited its own post.

It comes via the Centre for Economic Policy Research’s latest Frontiers of Digital Finance report, which is absolutely jam-packed with stablecoin insights from all our favorite thought leaders in the space (Cecchetti, Garratt, Portes, Andolfatto, Uhlig, to mention just a few).

The hard work here, however, has been done by Michael Junho Lee of the Federal Reserve Bank of New York:

It’s a fascinating insight into the evolution of stablecoin backing assets since 2020. What’s particularly notable is the degree to which “unreported” holdings have given way to precious metals in that timeframe.

Moreover, even now, “almost 13 percent of stablecoin reserves are held in non-compliant assets, including precious metals, cryptocurrencies, and unspecified financial assets.”

No surprises that “Non-compliant assets are predominantly held by non-US stablecoin issuers, notably Tether.”

The chart, however, doesn’t flag how many stablecoins are now backed with other stablecoins (a la the Ethena model) — though, perhaps, that’s because the share is still too small to matter?

Also interesting is the point from Michael Junho Lee that stablecoins currently meet creation and redemption requests on a gross rather than net basis.

As he notes (our emphasis):

“Stablecoin providers issue stablecoins after receiving US dollars from customers, and fulfill customers’ redemption requests after receiving stablecoins by sending a corresponding amount in US dollars. Both processes require stablecoin providers to hold commercial bank deposits. Consequently, redemptions are processed closer to a gross, rather than net, basis, resulting in greater intraday payment volatility. Second, greater integration to support stablecoin usage for day-to-day payment needs could also increase gross redemptions, transmitting payment-related liquidity shocks to banks and the Treasury market.”

We’ll be back with more insights from the report when we’ve fully digested it.

In the meantime, if you’re interested in geeking out on all this stuff “IRL”, do take part in our “London meet-up” doodle poll.